Company Profile Report:

Automotive Risk Management Market Company Profile Analysis: Company Overview, Business Overview, Company Strategy, Key Developments/Strategies, Financial Performance 2021 - 2024, SWOT Analysis, and Geographic Footprint.

The global Automotive Risk Management Market was valued at USD 8,730 million in 2023 and USD 9,620 million in 2024, projected to grow at a CAGR of 16.9%, reaching USD 28,760 million by 2031.

The automotive risk management market has experienced steady growth in recent years as the industry faces increasing complexities and regulatory requirements. This market encompasses a range of solutions designed to help automotive companies mitigate various risks, from supply chain disruptions to cyber threats and compliance issues. One key driver of this market is the rising demand for comprehensive risk assessment and mitigation strategies. Automotive manufacturers and suppliers must navigate a landscape of evolving regulations, technological changes, and global supply chain challenges. Effective risk management tools and services can provide these organizations with the insights and frameworks needed to identify, assess, and address potential risks before they escalate.

Moreover, the growing emphasis on safety and sustainability within the automotive sector has fueled the adoption of risk management solutions. Automakers are under pressure to ensure the integrity of their products, supply chains, and operations, which has led them to invest in advanced risk management platforms and analytics. While the market is competitive, with both established players and innovative startups offering specialized solutions, the overall outlook remains positive. As the automotive industry continues to evolve, the need for comprehensive risk management strategies is likely to become increasingly critical for companies seeking to maintain a competitive edge and ensure long-term resilience.

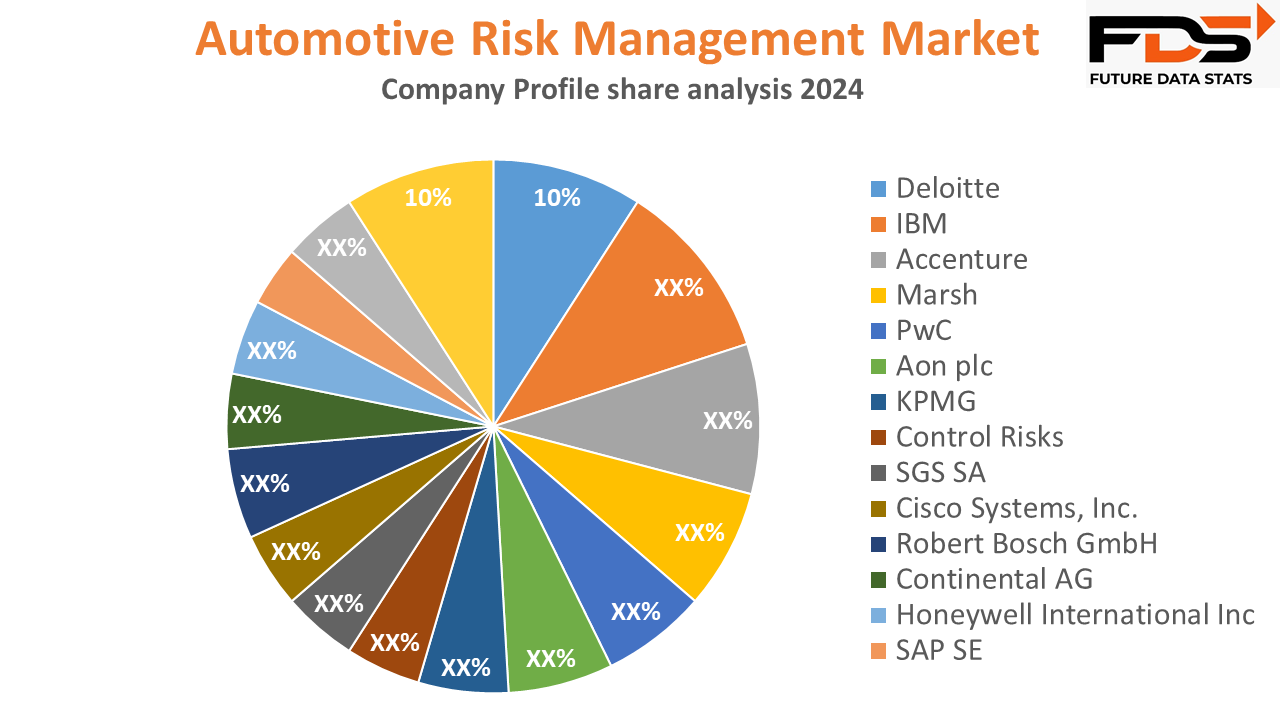

Market Key Players: Deloitte, IBM, Accenture, Marsh, PwC, Aon plc, KPMG, Control Risks, SGS SA, Cisco Systems, Inc., Robert Bosch GmbH, Continental AG, Honeywell International Inc., SAP SE, Oracle Corporation

TABLE OF CONTENTS

Chapter: 1 Introduction: Automotive Risk Management Market

1.1 Report description

1.2 Executive Summary

1.3 Company Market Share Analysis (2023)

1.4 Automotive Risk Management Market Size and Share Analysis 2020 - 2031

2 Chapter: 2 Company Profiles

2.1 Deloitte

2.1.1 Company Overview

2.1.2 Business Overview

2.1.3 Company Strategy

2.1.4 Key Developments/Strategies

2.1.5 Financial Performance

2.1.6 SWOT Analysis

2.1.7 Geographic Footprint

2.2 IBM

2.2.1 Company Overview

2.2.2 Business Overview

2.2.3 Company Strategy

2.2.4 Key Developments/Strategies

2.2.5 Financial Performance

2.2.6 SWOT Analysis

2.2.7 Geographic Footprint

2.3 Accenture

2.3.1 Company Overview

2.3.2 Business Overview

2.3.3 Company Strategy

2.3.4 Key Developments/Strategies

2.3.5 Financial Performance

2.3.6 SWOT Analysis

2.3.7 Geographic Footprint

2.4 Marsh

2.4.1 Company Overview

2.4.2 Business Overview

2.4.3 Company Strategy

2.4.4 Key Developments/Strategies

2.4.5 Financial Performance

2.4.6 SWOT Analysis

2.4.7 Geographic Footprint

2.5 PwC

2.5.1 Company Overview

2.5.2 Business Overview

2.5.3 Company Strategy

2.5.4 Key Developments/Strategies

2.5.5 Financial Performance

2.5.6 SWOT Analysis

2.5.7 Geographic Footprint

2.6 Aon plc

2.6.1 Company Overview

2.6.2 Business Overview

2.6.3 Company Strategy

2.6.4 Key Developments/Strategies

2.6.5 Financial Performance

2.6.6 SWOT Analysis

2.6.7 Geographic Footprint

2.7 KPMG

2.7.1 Company Overview

2.7.2 Business Overview

2.7.3 Company Strategy

2.7.4 Key Developments/Strategies

2.7.5 Financial Performance

2.7.6 SWOT Analysis

2.7.7 Geographic Footprint

2.8 Control Risks

2.8.1 Company Overview

2.8.2 Business Overview

2.8.3 Company Strategy

2.8.4 Key Developments/Strategies

2.8.5 Financial Performance

2.8.6 SWOT Analysis

2.8.7 Geographic Footprint

2.9 SGS SA

2.9.1 Company Overview

2.9.2 Business Overview

2.9.3 Company Strategy

2.9.4 Key Developments/Strategies

2.9.5 Financial Performance

2.9.6 SWOT Analysis

2.9.7 Geographic Footprint

2.10 Cisco Systems, Inc.

2.10.1 Company Overview

2.10.2 Business Overview

2.10.3 Company Strategy

2.10.4 Key Developments/Strategies

2.10.5 Financial Performance

2.10.6 SWOT Analysis

2.10.7 Geographic Footprint

2.11 Robert Bosch GmbH

2.11.1 Company Overview

2.11.2 Business Overview

2.11.3 Company Strategy

2.11.4 Key Developments/Strategies

2.11.5 Financial Performance

2.11.6 SWOT Analysis

2.11.7 Geographic Footprint

2.12 Continental AG

2.12.1 Company Overview

2.12.2 Business Overview

2.12.3 Company Strategy

2.12.4 Key Developments/Strategies

2.12.5 Financial Performance

2.12.6 SWOT Analysis

2.12.7 Geographic Footprint

2.13 Honeywell International Inc.

2.13.1 Company Overview

2.13.2 Business Overview

2.13.3 Company Strategy

2.13.4 Key Developments/Strategies

2.13.5 Financial Performance

2.13.6 SWOT Analysis

2.13.7 Geographic Footprint

2.14 SAP SE

2.14.1 Company Overview

2.14.2 Business Overview

2.14.3 Company Strategy

2.14.4 Key Developments/Strategies

2.14.5 Financial Performance

2.14.6 SWOT Analysis

2.14.7 Geographic Footprint

2.15 Oracle Corporation

2.15.1 Company Overview

2.15.2 Business Overview

2.15.3 Company Strategy

2.15.4 Key Developments/Strategies

2.15.5 Financial Performance

2.15.6 SWOT Analysis

2.15.7 Geographic Footprint

Some Key Reasons Why You Should Buy A Company Profile Report:

- Understand the Company's Background and Operations

- Gain insights into the company's history, founding, and key milestones.

- Learn about the company's core business activities, products/services, and operational model.

- Assess the Company's Financial Health

- Review the company's financial performance, including revenue, profitability, and cash flow.

- Evaluate the company's financial stability, debt levels, and growth trends.

- Analyze the Company's Market Position

- Understand the company's competitive landscape, market share, and industry trends.

- Identify the company's key strengths, weaknesses, opportunities, and threats (SWOT).

- Evaluate Management and Corporate Governance

- Assess the quality, experience, and track record of the company's leadership team.

- Understand the company's corporate governance practices and risk management policies.

- Identify Potential Risks and Opportunities

- Uncover any legal, regulatory, or reputational issues that could impact the company.

- Discover potential growth areas, new product/service offerings, or expansion plans.

- Support Decision-Making

- Utilize the comprehensive information to make informed decisions about investing, partnering, or doing business with the company.

- Enhance your understanding of the company's overall position and future prospects.

"The report will be delivered within 12 hours after payment"

No Reports found.